Deep Yellow Limited has announced a further postponement of the Final Investment Decision (FID) for its Tumas uranium project in Namibia. The decision, initially expected in Q4 2024 and later rescheduled to early March 2025, has been deferred once more due to ongoing challenges in the uranium market.

Project Overview and Delays

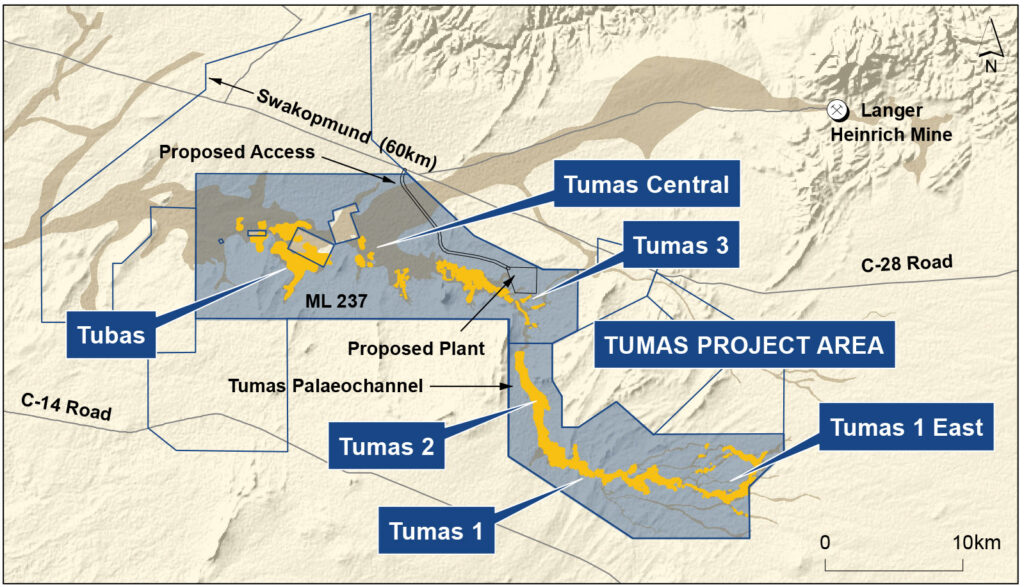

The Tumas project, located approximately 80 kilometers east of the Port of Walvis Bay, is one of the most advanced greenfield uranium developments globally. It boasts a substantial resource estimate of 67.3 million pounds of U₃O₈ and requires an estimated investment of up to US$372 million for development.

The initial delay in the FID was attributed to outstanding final costings, equipment and construction quotes, and opportunities for further project optimization. Despite significant progress in these areas, Deep Yellow’s Board has determined that the full-scale construction phase of the Tumas project will be strategically aligned with market conditions, particularly uranium prices.

Market Conditions and Strategic Considerations

Deep Yellow’s leadership has expressed skepticism regarding analysts’ forecasts predicting significant increases in uranium supply, arguing that these projections are overly optimistic in the short to medium term. The company emphasized that the rapidly growing demand for commercial nuclear power, coupled with limited greenfield uranium deposits, means the current uranium price cannot justify new development projects. A price increase is deemed necessary to incentivize new production and ensure industry stability.

Managing Director John Borshoff stated, “Although we have one of the most advanced greenfield uranium development projects available… the current long-term uranium price does not reflect what we see as a significant emerging supply shortage.” He further noted that while early works continue, the company will adopt a disciplined approach to starting construction of the processing plant, contingent upon improved uranium prices.

Financial Position and Future Outlook

As of September 30, 2024, Deep Yellow reported robust cash reserves of A$247 million with no debt, positioning the company favorably to progress project development when market conditions improve. The company remains committed to developing the Tumas project at the right time and under favorable market conditions to maximize shareholder value.

The outlook for nuclear energy remains optimistic, with substantial uranium supply required to meet future demand. Deep Yellow believes that achieving this supply increase will be challenging, providing the company with a competitive advantage in an anticipated more favorable price environment.

In the interim, Deep Yellow will continue early-stage infrastructure works and detailed engineering activities, ensuring the project remains poised to advance swiftly once market conditions align with the company’s strategic objectives.